While one small study may not prove anything concrete, e-commerce brands in the region can take note of the assertions.

Despite booming sales accelerated by the consequences of the pandemic, new research in June 2020 indicated that asean e-commerce players may have taken growth for granted at the expense of consumer experience.

Conducted by data content and social research agency Blackbox Research in partnership with consumer intelligence platform Toluna, the research report analyzed the current sentiments, expectations and sentiments of 4,780 consumers (aged between 18 and 60) across six ASEAN markets. Over a third of the consumers polled (39%) said they are less than satisfied with their digital commerce experience, citing concerns about delivery costs and services, product reliability and the authenticity of in-app reviews.

The report shows that while 56% of Gen Zers reported more online spending, the increase was as much driven by older consumers, with the largest increases occurring amongst Gen X (60%) and Millennials (59%). ASEAN consumers reported a spike in online spending in response to COVID-19, with over half of those surveyed (59%) spending more online, and the total online spend for the average ASEAN consumer had increased by almost a third (32%).

ASEAN dissatisfied with digital experience?

While consumers across the region have access to the same online services, consumer satisfaction varies from country to country. As far as this singular report is concerned, Indonesia (54%) and Malaysia (57%) recorded the lowest satisfaction levels in the region when it came to online experiences. In Thailand and the Philippines, which recorded the highest satisfaction scores, close to a third were less than satisfied (30% and 33% respectively).

Meanwhile, a considerable fraction of consumers in Vietnam (38%) and Singapore (39%) did not show full satisfaction with the e-commerce services. The findings suggest that that while major e-commerce brands including enjoyed high usage rates in the region, this growth had come at the cost of greater scrutiny from consumers.

Blackbox Research’s Yashan Cama, International Commercial Director, said that consumer frustrations about service quality could become make or break for major e-commerce brands. “We expect some of these cornerstone brands to experience a shake-up in the coming months if these existing problems are not quickly addressed. Our report has shown that consumers expect more from the e-commerce experience and will only become more discerning in future. Online retail has transformed from a niche operation to a key consumer service, and standards must improve in line with these expectations. Asean E-commerce players need to rectify core elements of the customer journey and the fulfilment cycle to address these pain points.”

Cama said that, with consumers now better-educated and informed, and 5G technology on the verge of transforming platform capabilities, current market leaders may fall by the wayside “if they do not shift to a more seamless experience.”

A shift towards local brands

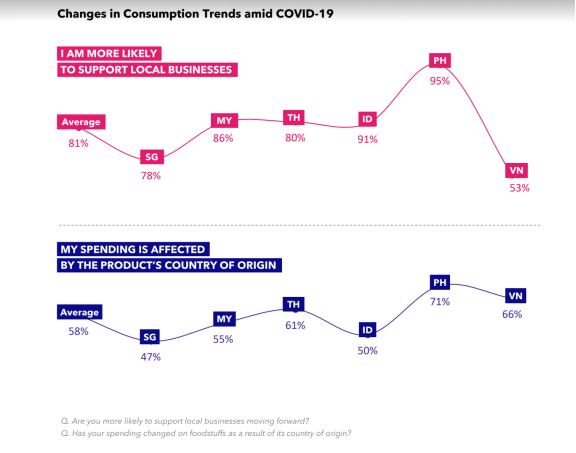

Another notable shift in consumer sentiment was a resurgence of interest in local brands detected in the study. Four in five ASEAN consumers said they were more likely to support local brands in the future, driven by a desire to strengthen their local communities and economy.

“Consumers are not rushing back to their old habits, so this new sense of life revolving around the home hub means companies need to rethink how they build this into the consumer experience in future. The home really has emerged as a new headquarters for many people. These changes go right to the heart of consumer behavior and require innovative approaches across the board from property developers, landlords, employers, through to retailers,” said Cama, adding that the term ‘International’ may be on the verge of becoming a dirty word. “Companies will need to assess their portfolios and seriously consider how they can localize their brands to reflect the values that matter most to ASEAN consumers.”