Digitalized businesses in the region need more data, yet they struggle to extract value from the data they already have: report

A survey of over 4,000 director-level decision makers in May 2021 across the world, including 1,000 respondents from nine Asia Pacific and Japan (APJ) markets (Australia, India, Indonesia, Japan, New Zealand, Singapore, South Korea, Thailand, and Vietnam), has indications that APJ respondents were struggling with the proliferation of data.

Instead of offering a competitive advantage, data had become a burden due to an array of barriers: data skills gaps, data silos, manual processes, business silos, and data privacy and security weaknesses.

This so-called “Data Paradox” by Dell Technologies, which commissioned the survey, was driven by the volume, velocity and variety of data that overwhelmed respondents in the areas of business, technology, people, and processes.

Survey findings

Three paradoxical trends that were discerned from the survey include:

- The Perception Paradox

67% of APJ (Global: 66%) respondents said their business was data-driven and cited that data is the lifeblood of their organization. Paradoxically, in APJ, only 21% (Global: 21%) of respondents testified to treating data as capital and prioritizing its use across the business.

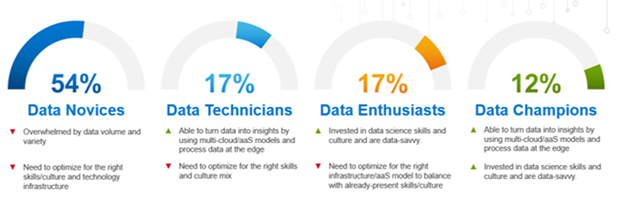

To provide some clarity around this paradox, the survey outlines an objective measurement of businesses’ data readiness.

Results show that businesses in the survey (Global: 88%, APJ: 88%) were yet to progress either their data technology and processes and/or their data culture and skills. Only 12% of businesses globally and in APJ were defined as Data Champions: companies that were actively engaged in both areas (technology/process and culture/skills). - The “Want More Than They Can Handle” Paradox

73% of APJ respondents (70% globally) said they were gathering data faster than they can analyze and use; yet 69% in APJ (67% globally) said they constantly need more data than their current capabilities provide. This could be due to the following data:

• 62% of APJ respondents (Global: 64%) guarding a significant amount of their data in data center they own or control, despite the known benefits of processing data at the edge (where the data is generated)

• 69% of APJ respondents (Global: 70%) ‘admitted’ their board still did not visibly support the company’s data and analytics strategy

• 54% of APJ respondent (Global: 57%) were bolting-on more data lakes rather than consolidating what they have

Consequentially, the explosion in data was making their working lives harder rather than easier:

• 66% of APJ respondents (Global: 64%) complained they had such a glut of data they could not meet security and compliance requirements

• 66% of APJ respondents (Global: 61%) said their teams were already overwhelmed by the data that they have - The “Seeing Without Doing” Paradox

The number of businesses that have moved the majority of their applications and infrastructure to an as-a-Service model was still small (APJ: 21%, Global: 20%) even though:

• 66% of APJ respondents (Global: 64%) saw the opportunity to scale to changing customer demands

• 65% of APJ respondent (Global: 63%) believed it would enable companies to be more agile

• 60% of APJ respondents (Global: 60%) predicted that businesses would be able to provision applications quickly and simply (with just the touch of a button)

• 81% of APJ respondents (Global: 83%) believed an on-demand model would help overcome any or all of the following barriers to improve capturing, analyzing and acting on data: high storage costs; a data warehouse that is not optimized; outdated IT infrastructure; processes that are too manual to meet their needs.

Finally, all respondents across APJ and globally intended to deploy machine learning to automate how they detect anomaly data, move to a data-as-a-service model, and re-architect (Global: 52%, APJ: 47%) how they process and use data in the next few year years.

Commented Amit Midha, President (Asia Pacific & Japan and Global Digital Cities), Dell Technologies: “At a time when businesses are under immense pressure to embrace digital transformation, they need to juggle getting more data in with mining the data that they already have.”