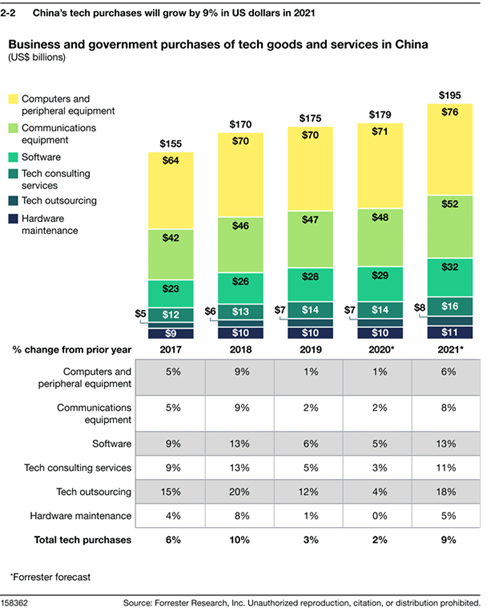

A market research firm believes the country’s tech spending will jump 9% this year in order to spur self-reliance.

Market research firm Forrester has projected that China’s tech spending will grow by 9% this year to reach US$195 bn.

Under the threat of continued pandemic and geopolitical friction (a Trump legacy that may hold sway in the Biden era), the resolve to improve business resilience, accelerate digitalization and adapt to uncertainty experienced in the last four years is clear.

The need for technological self-reliance has become a top priority in China, with the New Infrastructure program driving domestic tech spending. The country’s government claims it will act to make China more open to the world by driving bidirectional technology investments locally and globally.

In addition, Chinese firms will invest in emerging technologies to power their business transformation. They will prioritize AI, new compute infrastructure, and next-generation communications for technology acceleration. They will also focus on automation and the internet of things (IoT) for business enablement, according to Forrester’s forecasts.

The key forecasts are as follows:

- Hardware investments will accelerate and remain dominant.

Investments in 5G and all-optical networks (AONs) are accelerating. Geopolitical friction is also driving investments in critical hardware: Chinese firms in the semiconductor industry raised nearly US$38bn in 2020, more than double 2019’s total. Enforced remote-working has also increased the need for upgrading of home personal computing equipment. As a result, spending on computer and communications equipment is expected to reach US$76bn and $52bn respectively, and will remain the top two areas in terms of overall tech spending in 2021. - Tech outsourcing and consulting services will recover and maintain growth.

Chinese firms have largely overcome pandemic-related concerns about in-person consulting services. The benefits of remote operations and online businesses are forcing local firms to revisit some IT architecture principles. As a result, they will seek help from vendors in tech consulting, tech outsourcing, and public cloud services—especially in areas like automation, AI, and cloud-native tech—that can help them simplify operations and address the needs of hyperdynamic customers. - Automation and collaboration will give software new momentum.

Key areas like Cloud, AI, IoT, and e-commerce will continue to drive software growth in 2021 in China. The pandemic will continue to drive investments in automation and collaboration: 41% of data and analytics decision-makers polled in China expected their firms to use robotic process automation (RPA) in 2020 for intelligent automation. The enterprise collaboration market had already seen explosive growth, powering organizational agility for local enterprises. As a result, software spending will grow 13% this year to reach US$32bn.