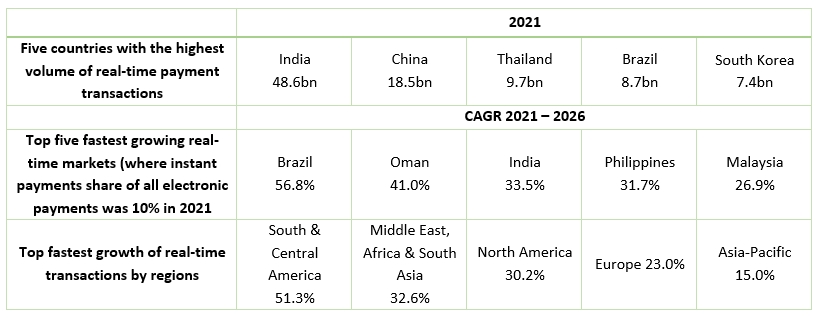

APAC topped real-time payments market growth globally, with Thailand leading the way in terms of volume and economic growth.

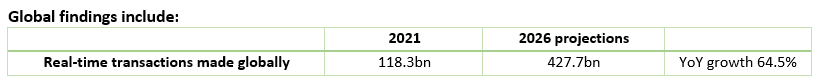

As markets in the Asia Pacific region mature, the adoption and sophistication of facilitating real-time payments are showing a positive impact on economic growth, according to a report tracking real-time payments volumes and growth across 53 countries and reviewing the economic benefits of the technology for consumers, businesses, and the broader economy across 30 countries.

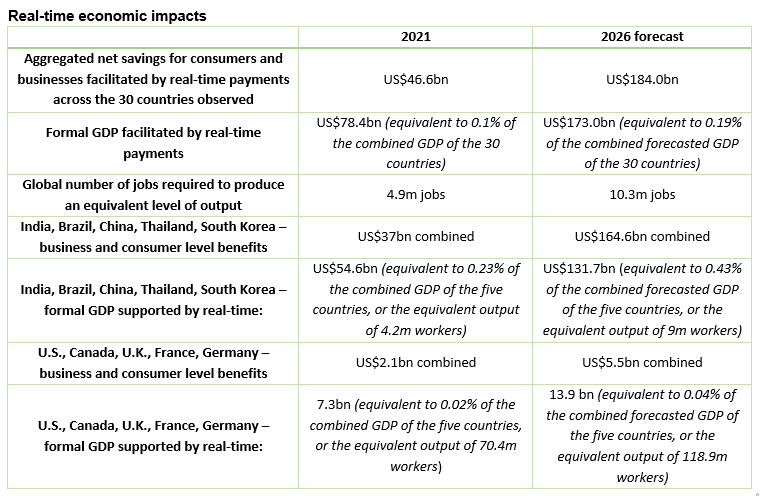

The research concludes that governments that advance the real-time modernization of their national payments infrastructure create a win-win situation for all stakeholders in the payments ecosystem: both consumers and businesses stand to benefit from fast, frictionless and hyper-connected payments services.

In addition, financial institutions can future-proof in a highly competitive environment by speeding up cloud-first and data-centric modernization, while governments can leverage such efficient payment systems to boost economic growth, reduce the size of their shadow economy and create a fairer financial system for all.

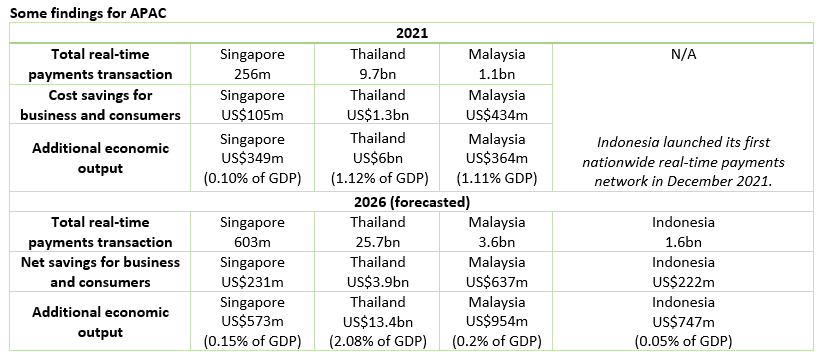

Data for Malaysia, Singapore, Thailand

Research footnotes remind readers that, to estimate the potential maximum additional benefit that real-time payments present, a ‘counterfactual framework within each country that estimates the efficiency savings and wider benefits associated with hypothetical 100% real-time utilization’ had to be constructed. “It must be stressed that full real-time adoption is not a realistic or likely scenario for any country in the near-term future, even for those with the most advanced payment systems. In general, while we are seeing a shift away from paper-based instruments based on the information regarding the payments landscape today, full real-time adoption is not realistic for the timeframe assessed within this study. Results should be considered indicative of the potential scale of benefits, rather than any form of prediction or forecast.”

According to Leslie Choo, Head of the Asia Pacific region, ACI Worldwide, which commissioned the research: “APAC remains at the forefront of real-time payments innovation as its real-time base pivots towards larger volume transactions and more sophisticated services for our businesses and consumers,” noting that the next stage of evolution for the region is to develop linkages to provide a truly pan-regional real-time infrastructure and addressing the region’s vast unbanked and underbanked population.

Owen Good, Head of Advisory, Centre for Economics and Business Research, which conducted the research, said: “By allowing for the transfer of money between parties within seconds rather than days, real-time payments improve overall market efficiencies in the economy. Real-time payments improve liquidity in the financial system and therefore act as a catalyst for economic growth. This is especially important for our fast-paced and digital-led gig economies. Workers are paid quickly, allowing them to better plan their finances. Instant payments allow businesses to be more flexible and reduces the need for burdensome cash flow management.”