No, argues this expert: security and frictionless user experience can coexist if AI is used to eyeball and manage user activity.

During these unprecedented times, traditional banks and financial services institutions (BFSIs) face unique operational challenges and have to rapidly expand their digital service offerings in order to navigate economic disruptions.

According to IDC’s latest infobrief, banks in the Asia Pacific region (APAC) are rethinking processes and digitalizing processes, with 70% planning to adopt real-time payments by 2022.

Central to the demand for digital BSFI services are consumers’ rising expectations for remote, convenient, socially-distanced 24/7 transactions; many people will likely stick to online banking even after the pandemic’s wake.

For BFSIs, providing strong and secure digital platforms is paramount for building and maintaining brand trust particularly at a time when cyberattacks are on the rise. However, the strict access controls for many BFSI applications are often at odds with ease of use, frustrating consumers, and the business alike.

Security: a boon or a bane?

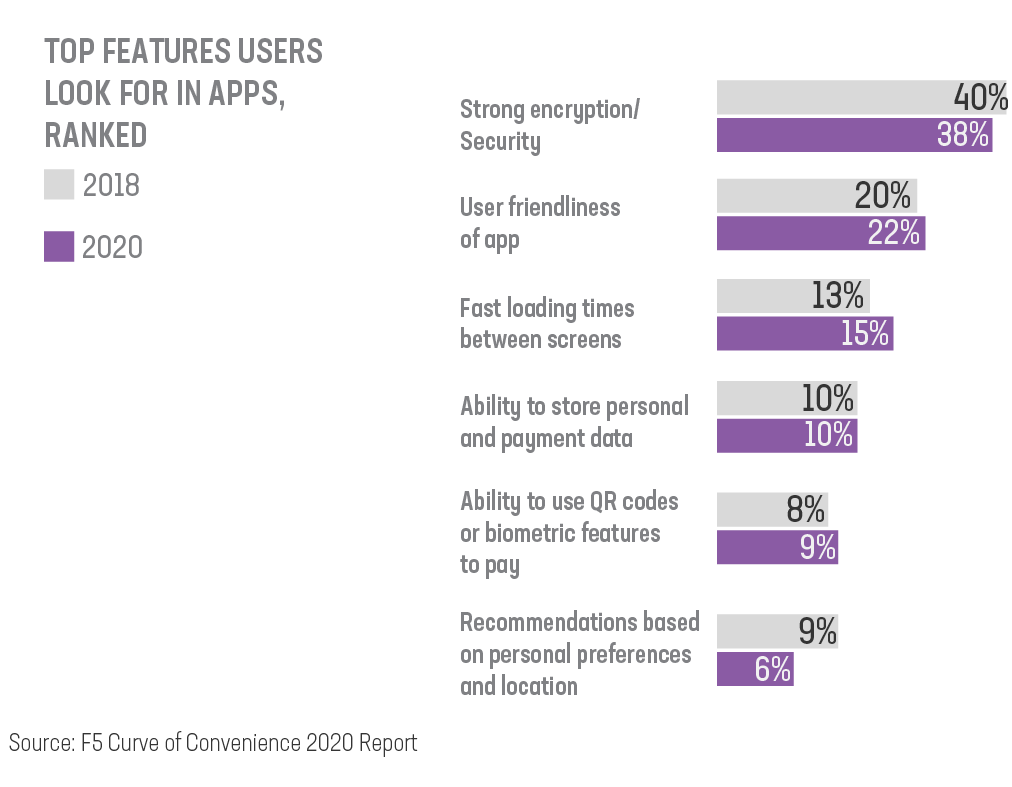

In practical terms, application user-friendliness and load times are among the top three most important features, indicating that usability is gaining traction as a key consideration for whether to download or continue using a BFSI application.

To encourage download and usage—with the need for frictionless user experience in mind—the BFSI industry has implemented sophisticated security systems such as multi-layered authentication. For consumers, this can be easily recognized through various methods: for instance, when logging-in to bank applications, they are asked to input their username and password followed by a two-factor authentication, security questions, CAPTCHA or biometrics (fingerprint or facial recognition).

While these new solutions have been successfully implemented to prevent online frauds, they can be cumbersome for consumers and cause disruptions in their overall digital experience.

Reducing the friction

When attempting to reduce friction in customer experience, identity verification has always been a constant and persistent battleground for the industry. Fortunately, advances in web application security solutions have made it possible to leverage AI to protect banking applications from the rising tide of fake internet traffic.

Using AI can accurately determine in real-time if an application request is from a human or a bot, and it can further differentiate between a bad actor and authorized individual. This approach stops bad traffic without introducing login friction for legitimate users with additional layer of security protection.

When banks and financial institutions have end-to-end visibility of legitimate users behind every interaction, they can also gain valuable insights on their customer, enabling them to create personalized, trusted and frictionless digital experiences.

Process of constant reinvention

The race towards greater digital payments adoption will reshape not only traditional banking systems but also the digital customer experience.

BFSIs should focus on delivering unparalleled service experiences that are smart, fast and secure … or risk falling behind both their industry counterparts and non-financial service competitors that are also quickly and continually transforming their businesses.

Because this is how the digital banking and financial services in the post-pandemic era will look like: a process of constant reinvention.