Analytics data point to a buoyant season between Nov and Dec due to lockdowns and Election Week, among other factors.

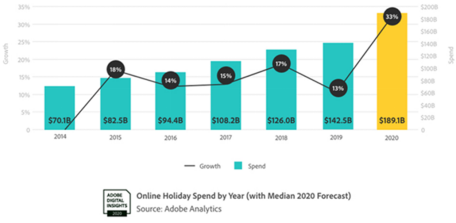

Analytics data for the US indicate possible online holiday sales of US$189bn, shattering all previous records with a 33% YoY increase, equal to two years’ growth in one season.

The most anticipated gifts of the holiday season include video games such as Cyberpunk 2077, Call of Duty: Black Ops Cold War and Super Mario 3D All Stars, and game consoles such as PlayStation 5 and Xbox Series X, according to Adobe Analytics.

Instead of Cyber Week (Thanksgiving Day – Cyber Monday), Adobe expects November and December to turn into Cyber Months this year. In the weeks leading up to the US Thanksgiving weekend (Nov 1 – 22), Adobe predicts that consumers will spend $56 billion, a 37% YoY increase.

Additional predictions

Analyzing trillions of data points that flow through Adobe’s web services that track visits to US retail sites, 100 million stock-keeping units and 80 of the 100 largest retailers in the US over 50 merchandise categories—as well data from a survey of 1,000 US consumers in October 2020—the following predictions have been made by Adobe:

- Election Week (Nov. 1-7) will total US$16.3 billion in online sales. On the day after the election, online sales will grow 11% slower than the full week. Some 26% of consumers said that the outcome of the election will impact their holiday spending. Based on past elections, online sales were negatively impacted after the outcome was known. Online sales were down 14% the day after the 2016 election, and online sales dropped by 6% the day after the 2018 mid-term election.

- Daily records: Online sales will surpass US$2 billion every day between Nov 1 and Nov 21 and increase to US$3 billion a day Nov 22–Dec 3.

- Early discounts in November: Significant holiday discounting will begin within the first two weeks of November and build to the deepest category price drops over Black Friday through Cyber Monday:

- Black Friday will be the best day to get discounts on appliances (discounted by 11% on average) and TVs (19%)

- Best discounting for toys (20%) and furniture (10%) will fall on Sunday, Nov. 29, the day before Cyber Monday

- Black Friday, Cyber Monday: Black Friday is projected to generate US$10 billion in online sales, a 39% YoY increase; Cyber Monday will remain the biggest online shopping day of the year with US$12.7 billion, a 35% jump YoY.

- Small vs large retailers: Small retailers (US$10m–$50m annual online revenue) will see a larger boost to revenue (107% boost) vs large retailers (84% boost). However, large retailers will continue to dominate with online sales growing 55% YoY versus 8% for small retailers.|

- New shoppers: Adobe expects 9% of all holiday customers to net new online shoppers due to the pandemic, and conversion rates are expected to increase significantly (13%). The Average Order Value (AOV) is expected to stay flat YoY.

Said John Copeland, head of Marketing and Customer Insights, Adobe: “This year is unlike any in the past, and for the first time we are no longer referring to peak holiday sales as Cyber Week: it’s now Cyber Month. As retailers adapt to new consumers behavior in this pandemic, we expect earlier discounts, more shipping and pick-up options and uncertainty around in-store purchases to drive this year’s online holiday sales to record highs.”