Amid increased adoption of mobile wallets, digital payment and instalment services, APAC respondents varied in the trust levels of data protection.

In a March 2022 online survey 6,000 consumers and 2,000 businesses across 20 countries, including the Asia Pacific region (APAC: Australia, China, India, Indonesia, Malaysia and Singapore)—on insights related to consumer and business economic outlooks, financial well-being, online behavior and more over the past seven years—digital payments have now overtaken credit cards as the preferred payment method for APAC respondents.

The data shows that ‘Buy Now Pay Later’ services have been gaining popularity in the past six months: especially in Australia (28%), China (28%), and Indonesia (32%).

However, there remains a gap in between consumer expectations and the digital experience businesses can offer, with only one in five Singaporean respondents indicating that businesses have completely met their expectations for digital experiences—the lowest across respondents in the region.

Other findings

In the survey, APAC consumers were willing to share personal data with businesses in exchange for better services.

- 74% of In Indonesia respondents (consumers) had indicated they were ‘very’ and ‘somewhat’ willing to share their personal data, the highest in the region.

- Elsewhere across the region, respondents remained cautious about sharing payment or transaction data

- 84% of Malaysia respondents had indicated they were ‘very’ and ‘somewhat’ concerned with online transactions and activities.

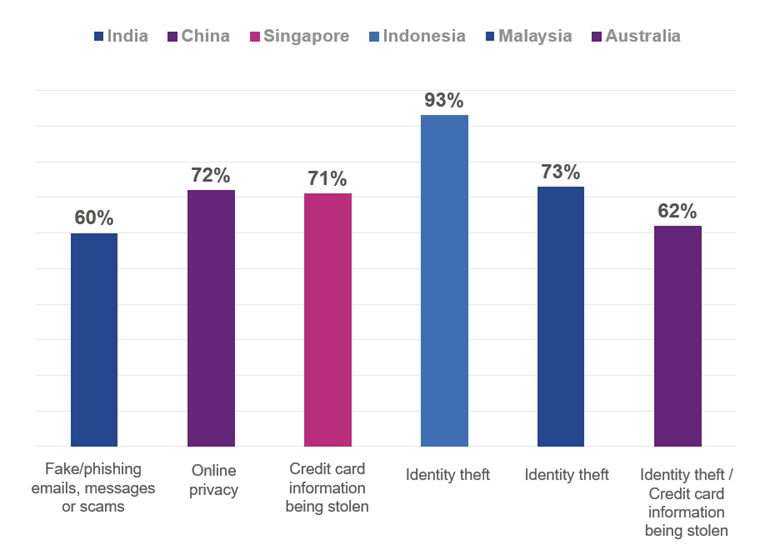

- While many respondents in the region remained wary of their digital experiences, their top concerns varied from market to market, as follows:

According to Luciano Scalise, Decision Analytics Managing Director (EMEA & APAC), Experian, which commissioned the survey: “As consumers in the region continue to embrace digital interactions, it is imperative for businesses to understand and be able to address consumers’ specific needs and concerns efficiently. Prioritizing data insights and technology-driven solutions are crucial (steps) for businesses to stay ahead of the game” to “make smarter decisions and thrive, to lend more responsibly, and (in) protecting consumers and organizations from identity fraud and crime in this evolving landscape.”