Digital payments, donations, merchandise delivery and pandemic-related relief are now bridging the giant gaps left by nationwide lockdowns.

With the movement restrictions in force all around the world in the fight against COVID-19, people are increasingly turning to technology to minimize disruption in their everyday lives.

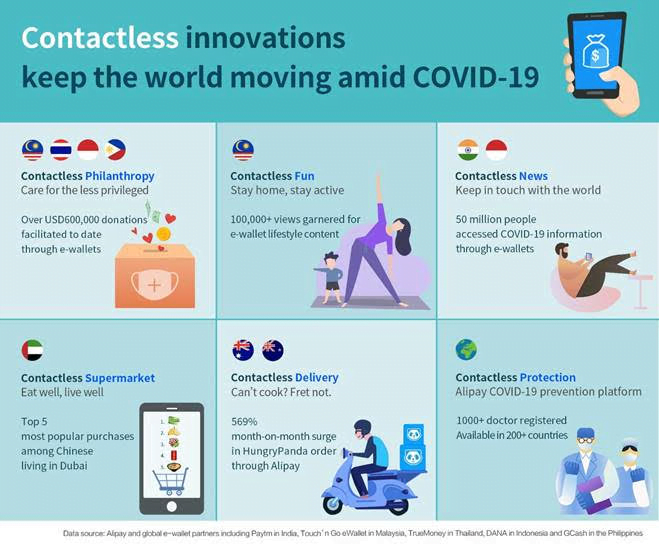

Contactless payments, for example, have become an essential part of shopping online, paying bills and ordering food. Furthermore, contactless payment platforms are fast evolving to deliver more innovative functionality and fulfil financial activities such as payroll, entertainment, and even donations.

In Malaysia, Thailand, Indonesia and the Philippines, local users have gathered donations through their e-wallets, raising more than US$600,000 in contactless donations. These donations to charitable organizations enable vulnerable groups to immediately access the support they need, including food, masks and other protective equipment.

In India and Indonesia, nearly 50 million people are even using e-wallets to access accurate and timely information about the pandemic. E-wallets in South and Southeast Asia include TrueMoney in Thailand, GCash in the Philippines, Touch ‘n Go eWallet in Malaysia, and bKash in Bangladesh. These services have adapted their products quickly to help support some normality in people’s lifestyles.

Philippines and Thailand

For a country where cash has persisted as the dominant payment method, this practice has been reduced significantly during the nationwide lockdown in the Philippines. Instead, locals have turned to online and mobile wallet services for both convenience and safety. GCash has seen a surge in the number of downloads there, and has been ranked as the most downloaded free app in the Finance category in the Google Play Store.

Since March, the most used services in the GCash wallet have included Buy Load and Remittance, with the total transaction volume growing by more than 30%.

Image source: TrueMoney

Since March 2020, Thailand has implemented a series of measures including postponing the Songkran holidays, recommending that people stay home, limiting business hours and encouraging telecommuting where possible. Many businesses have had to close temporarily. Only supermarkets and food and beverage outlets remain open, but they are limited to offering take-away and delivery options only.

In order to comply with the measures and to reduce the risk of infection, TrueMoney has joined hands with popular local merchants such as 7-Eleven, Makro, CP Freshmart, True Coffee, Chester’s as well as street-food stall sellers to promote contactless payment and hygiene awareness. TrueMoney’s newly-launched in-app feature “Shop Near Me” helps consumers easily locate nearby stores and place orders or requests for delivery.

With the adoption of contactless payments accelerating during the pandemic, TrueMoney has seen the number of app downloads grow by 20% in recent months.

Bangladesh

Image source: bKash

While the pandemic rages on, Bangladesh has tightened enforcement of social distancing rules and extended the nationwide lockdown.

bKash, the largest mobile financial services provider there, has been working closely with the government to facilitate the distribution of salaries and government incentives to workers, serving around 40 million users.

As most workers do not have bank accounts, bKash as an integrated platform, is helping them receive their salaries through mobile wallets. After receiving their salary, workers can cash out from any of the 230,000 bKash agent-points located across the country, or use cashless services like Send Money, Mobile Recharge, Payments, etc. Thanks to the government initiative to disburse payments through mobile financial service providers like bKash, many workers have been able to receive their monthly salary. Said one beneficiary: “Thanks to the authorities as well as bKash for making a way for me to get my salary without being physically present at the factory. This service has been a lifeline for many workers like me.”

#3: Contactless Philanthropy – more people donating from the safety of their homes

Malaysia

Ewallet service Touch ‘n Go is extending a helping hand to the underprivileged communities by providing a better solution for the rakyat to offer financial relief directly to local non-governmental organizations (NGOs).

As the nation’s choice for cashless transactions, Touch ‘n Go eWallet has made it a priority to highlight the plight of those in its network such as Kechara Soup Kitchen, Tzu Chi Buddhist Foundation and Generasi Gemilang. Proceeds are channeled directly to Malaysian NGOs, enabling a more effective and more efficient response to the needs of vulnerable and low income families.

To date, Touch ‘n Go eWallet has facilitated donations worth more than RM280,000 to a total of 22 NGOs in Malaysia.

Kechara Soup Kitchen for example, was able to raise enough funds to provide food and essential items to the low-income families who have been affected by the pandemic. Single parents, elderly people living alone, and families who have lost their source of income from the low-income urban areas to the Orang Asli community in Kampong Orang Asli Lebak, Gabong, Pasir, and Bentung areas, are now receiving the help they desperately need in the form of food and health essentials.

Struggling non-Malaysians have not been left out. Tzu-Chi Buddhist Foundation, with the aid of donors, have raised funds to distribute food and health essentials including face masks and hand sanitizers which are increasingly difficult to purchase.

To support citizens and residents of Malaysia to continue living healthy and productive lives at home, Touch ‘n Go eWallet introduced the MCO Buddy platform featuring curated lifestyle content and information on making charitable donations, all aimed at keeping people engaged and active.

Since the roll-out in early April, MCO Buddy has garnered more than 100,000 views and widespread support from the local community, including fitness guru Kevin Zahri and celebrity chef Sherson Lian, both of whom are regular content contributors to the platform.