One chief controls the budget; the other controls the ROI: if they fail to synergize, the entire business suffers: report

When it comes to digital transformation (DX) and its significance amongst other corporate priorities, 80% of CFOs in a recent global study cited that DX is within the top-five of their list of priorities; 71% believed that DX investments are key to their company’s success; and 77% said they would help the CIO find a way to fund a new DX project if the initiative delivered strong ROI.

In addition, 67% of respondents said they “refuse to waste precious dollars on IT investments that don’t move the needle.”

The survey involved around 1,500 CFOs and senior financial leaders across 13 markets covering companies with at least US$200 million in annual revenue. Its aim was to identify CFOs’ perceptions of DX, their IT spending priorities, how they measure the ROI on technology investments; and their viewpoints on the CFO-CIO partnership.

Bullish about DX

In addition to the large majority that cited DX as a top-five priority compared to other corporate initiatives, 59% cited it was actually in their top three priorities. Also, of the 80% of respondents that expected their technology spending to increase in 2021, almost half (46%) said this growth in spending was being driven by new DX investments.

Some 73% of respondents indicated that the global pandemic had increased their DX investment, and 95% agreed that technology investments were key to recovering from the business impacts of the pandemic.

Other observations from report include:

- When asked about the type of IT projects CFOs wanted to see more of from their CIO, “optimizing existing technology investments” topped the list (44%) followed by “revenue-generating technology initiatives” (40%) and “process improvements and employee efficiency” (39%).

- 70% of respondents said they wanted to cut spending on non-essential IT investments. When asked about the type of IT projects they personally preferred to cancel when they did not see clear business value or strong ROI, responses included “next-generation disruptive technology initiatives” and “major ERP reimplementation and migration projects.” When there is unimpressive ROI, technology for technology’s sake or forced by major ERP vendors does not satisfy CFOs that want to see strong business value for IT investments.

- 88% of respondents preferred that the CIO involved them before the business plan was fully crafted. Some 47% of respondents would rather have the CIO engage as the business plan was being developed, and 41% wanted IT to partner with Finance when the idea was fully formed but before the business plan was completed.

- Technology is expanding the role that CFOs and CIOs play in an organization, and also expanding the need for a close collaboration between IT and Finance. 92% of respondents ‘agree’ that “a successful CFO has a great relationship with their CIO counterpart.”

- 69% of respondents had a favorable view of their CIOs, with 47% stating that their CIO was a partner “that helps connect the dots between technology and business decisions” and 22% stating that their CIO was an “innovative change-agent that drives business strategy”.

- 77% of respondents shared that last year’s challenging business landscape served to strengthen their relationship with their CIO. Some 52% attribute this change primarily to an increased focus on security, compliance and risk; 50% cited the urgent need to collaborate to make nimble technology decisions; 42% cited the CIOs’ proactive engagement with them.

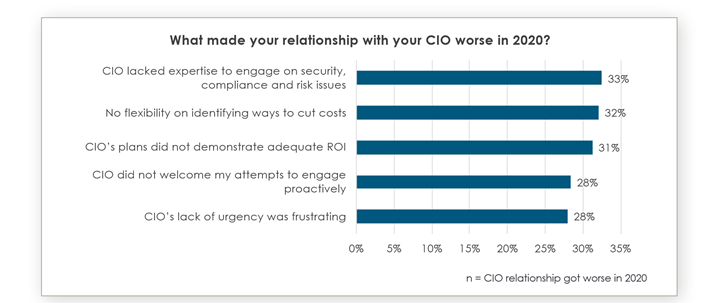

- Respondents who experienced a worsening relationship with their CIO last year, cited their CIOs’ lack of flexibility on identifying ways to cut costs (32%), the CIOs’ inability to demonstrate adequate ROI (31%); and CIOs that did not welcome attempts to engage proactively (28%).

- 92% of respondents said that the CIO needed to be more business savvy now than they were two years ago, and 94% ‘agreed’ that CFOs needed to be more technology savvy than they were two years ago.

- Respondents expected the ROI on technology spending to be swift, with 46% expecting to see ROI on their technology investment within two years, and 82% expected payoffs within three and five years.

- When asked how they would respond to their CIOs DX proposal requiring additional investment that would likely deliver a strong ROI, 77% of respondents said they would help the CIO find a way to fund the project, and 28% would even go to bat with the Board to help the CIO secure needed funding.

Said Seth A. Ravin, CEO of Rimini Street, which sponsored the survey: “IT investments must have clear business value to receive CFO support. It’s not surprising that CFOs want to cancel IT projects that lack a strong ROI, given that resources can be liberated for new technology investments that accelerate achieving the businesses digital goals.”