A recent study points to landscape changes and churns that telcos in the region can learn from.

Smartphone competition in the little island of Singapore has been unique in the region for various reasons. However, the days of an ever-increasing market hungry for phone contracts and flexible data usage plans are now at a plateau.

In a recent study, it has been found that the market there is no longer growing, while the number of telco service suppliers has increased from the previous three main players (M1, Singtel, Starhub) to a fourth entrant (TPG) and numerous mobile virtual network operators (MVNOs) such as Circles.Life, redOne and VIVIFI. MVNOs do own independent communications resources but rely on other operators to provide wireless spectrum and mobile network infrastructure.

This landscape had for some time been creating customer ‘churn’ as people started trying out different telcos. Only in April 2020 did the country’s IMDA see a drastic drop in the number of total mobile subscriptions, likely due to many TPG users ditching their free accounts once the operator launched its commercial plans on March 31, 2020. After that, the agency had reported a significant increase in the total number of ported subscriptions, which refers to the number of subscribers who retained their mobile numbers when they switched to a new mobile operator.

This confirms that churn is getting more dynamic and is gaining importance in the island’s mobile market.

Notable impacts

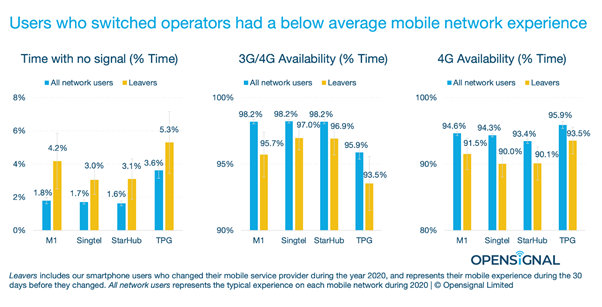

According to mobile analytics firm Opensignal, Singapore users who changed their mobile operator on average had a worse mobile experience before they switched compared to the typical experience on their original network. Also, its data showed that Singapore’s fourth mobile operator — TPG — as well the MVNOs, have been chipping away at the three main players’ subscriber bases.

Other notable trends discerned from the two-year data:

- M1, Singtel and StarHub have been losing smartphone users to TPG and the numerous MVNOs in the past two years. According to our data Singtel bore the brunt of the losses, while M1 and StarHub’s net attrition rate apparently stabilized after going into the negative during the first part of 2019.

- TPG’s growth rate had changed after its commercial launch in Apr 2020. It had been steadily losing trial users, but that trend flattened out. TPG started losing slightly more users to churn than it was receiving as additions. This trend change coincided with the telco’s commercial launch, which meant consumers could no longer sign-up for the free-trial plan.

- In recent months, OpenSignal had observed an increasing number of users moving towards MVNOs offering cheap SIM-only mobile plans including Circles.Life, redOne, VIVIFI. These changes suggest that the current economic challenges caused by the COVID-19 pandemic are raising mobile subscribers’ price sensitivity.

- Users experiencing mobile network pain points were more likely to change their mobile service provider. This can be seen in the data showing that those jumping ship to other telcos had on average a worse mobile experience before they switched than the typical experience observed by users who did not switch. These ‘leavers’ across all four national telcos on average spent between 47% and 133% more time without a mobile signal compared to the average; they also spent less time connected to either a 3G or 4G mobile connection — 3G/4G Availability — and experienced lower 4G Availability.

What can regional telcos learn?

TPG’s long gestation period in Singapore’s mobile market—as well as the launch of numerous MVNOs offering cheap SIM-only plans—has increased the number of attractive low-cost mobile offers available to customers.

The Opensignal analysis shows that price alone does not explain churn—not even in a market like Singapore with many low-cost brands. An extremely important driver of churn seems to be the quality of mobile network experience.

Telcos in the region have their own unique geographic challenges and logistics constraints. However, they can benefit from analyzing data to understand possible factors such as how competitive pricing cannot retain customers if they latter have a poor network and customer experience. As the region goes into digital transformation overdrive, governments can also take the lead in ensuring sufficient fair competition and availability of choice, agility, flexibility and service quality.