94% of survey respondents agreed that Singapore is currently facing an acute fintech talent shortage.

Michael Page Singapore recently published its Fintech Employment 2019 report, which revealed that 94% of fintech companies surveyed agreed they were facing major shortage of fintech talent.

The report showed that enlisting of fintech talent proved to be challenging experience, with 64% of employers expressing difficulties. 40% of respondents shared that the biggest obstacle for them is the lack of professional skills available.

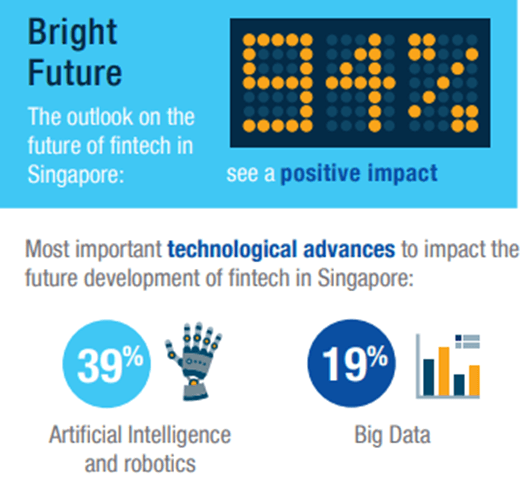

Keeping skilled employees is not an easy task either, as 37% shared that they had switch jobs in the last 12 months. 39% of the respondents also viewed artificial intelligence and robotics as one of the most important technological advancement to impact the future development of fintech in Singapore.

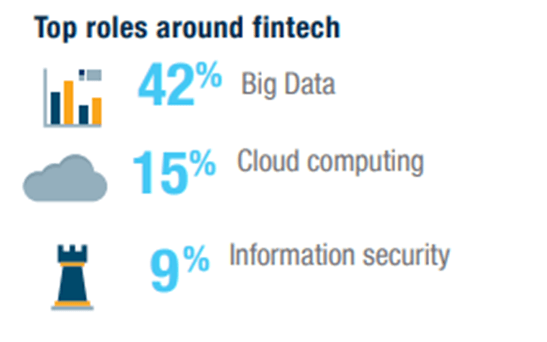

Optimistic about the employment opportunities today, “In what is expected to secure Singapore’s position as a leading fintech centre, the Bank for International Settlements (BIS) has announced plans to set up an innovation centre in Singapore. The establishment is set to observe critical technology trends affecting central banking globally. This is anticipated to increase job creation in the big data, cloud computing and information security spaces,” said Nilay Khandelwal, managing director, Michael Page Singapore.

Addressing the talent crunch, Khandelwal said: “Businesses need to attract and upskill key talent in Singapore’s tight labor market.”

Candidates in this space stated that their key motivators are technological capabilities and future adoption, a clear career path and company culture fit. 21% said that they expect salary raises ranging from 12-15% when securing a new role.

To ease this acute talent shortage in fintech, “Singapore also needs to nurture and produce top quality industry-ready talent through education to ensure that it has the capabilities to continue to grow its fintech industry,” Nilay Khandelwal stated.

Further, Singapore’s central bank has pledged an offering of up to five digital bank licenses to suitable applicants. This move is earmarked as the next frontier in Singapore’s banking liberalization and looks forward to the innovative value propositions external firms can introduce.

Overall, the respondent community predicts that fintech will play a key role in Singapore’s economic future, with a staggering 94% anticipating a positive impact.

Also, the number of local consumers adopting fintech products and services has drastically risen in the last two years, tripling from 23% in 2017 to 67% in 2019. Consumer companies are working hard to stay ahead of the pack with their advanced electronic payment systems and digital wallets.