After profiting from rescuing industries for two years, the APAC IT industry’s growth rate is expected to average around 6.2%.

What are this year’s biggest risks to business growth amid continued pandemic uncertainties?

How will supply chain bottlenecks and persistently high inflation affect consumer spending and enterprise investments?

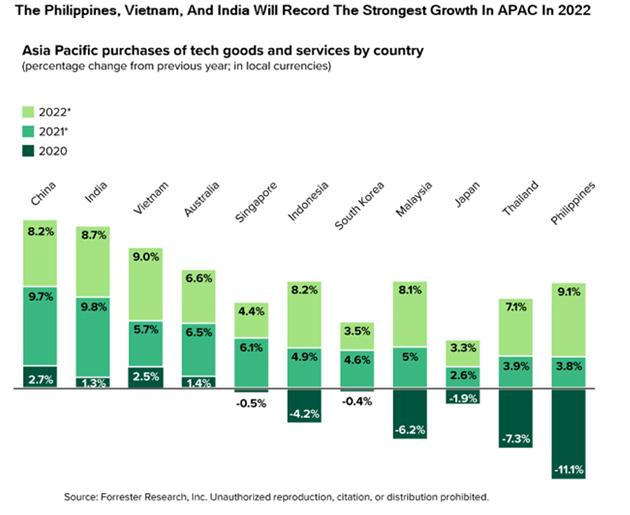

Market research firm Forrester expects that, based on continuous improvements in vaccination rates and the progressive reopening of economies, 2022 will see the APAC tech market grow by 6.2%.

Key highlights from the firm’s forecast

- The Philippines, Vietnam, and India are expected to lead tech growth rates this year, with purchases of tech goods and services expected to reach 9.1%, 9.0%, and 8.7%, respectively. Tech spending in Malaysia and Indonesia will grow by about 8% and by 7.1% in Thailand. China’s tech market growth will slow a bit, from 9.7% in 2021 to 8.2% in 2022. In Australia, we expect massive 6.6% growth in 2022, well above the CAGR from 2015 to 2019.

- New customer relationship management, business intelligence, digital experience, and human capital management projects will drive software investments in 2022 across the region. Demand for emerging technologies such as 5G, IoT, AI and blockchain will also fuel growth.

- Tech outsourcing will hold its momentum to grow by 7.7% driven by strong growth in public- and private- cloud infrastructure services. Tech outsourcing categories such as managed security services and data management services will also do well.

- Tech consulting and systems integration services will grow by nearly 6%, driven by modernization work.Cloud migration projects will accelerate across the region, and application modernization will increasingly replace ‘lift-and-shift’ projects. As firms rushed to develop new features and digital services in the past years, technology debt has risen, so organizations must now modernize their capabilities and get rid of accumulating tech debt.

- Computer equipment sales growth will slow to 4% after a strong 2021, as the urgency is subsiding.

In 2022, the consultancy firm sees growth in some collaboration equipment slowing as supply chain issues continue to plague the industry and the reopening of offices across the region limit further home equipment purchases.