By launching a one-stop digital banking service and mobile app to catch the wave, the bank hopes to stay relevant and user-friendly.

As the popularity of investing via digital channels grows, consumers want an easier and faster way to move their money to and from their bank accounts. At the moment, we usually need to switch between the mobile apps of various banks to juggle our finances and investments.

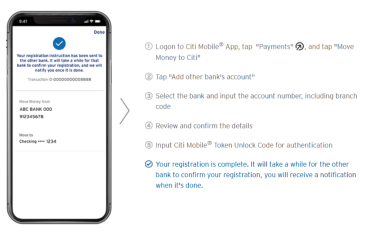

In view of increased client need for wealth management via digital channels due to social distancing and productivity reasons, one bank has launched a one-stop service that does just that. Citibank Hong Kong’s ‘Move Money to Citi’ service was recently launched in the Citi Mobile App to facilitate real-time money transfer from accounts at other banks to Citibank accounts.

With just a few taps on the app, registered users of the service can transfer money from the accounts they hold at other local banks to their Citibank accounts in real time, and not need to switch between the mobile apps of different banks. The new service integrates with other local and global payment capabilities that the bank is currently offering.

Said Winnie Choi, Head of Wealth Management, Citibank Hong Kong: “We see that more and more people are going digital to manage their wealth now. Citibank keeps embracing digital innovations, and our (wealth management tools) provide convenient and professional banking services to clients, from the first day they pull in money to our bank and along their whole wealth management journey with us. This is how we provide a one-stop digital wealth management service.”

In line with the global digitalization drive, the bank has been actively developing its digital banking service despite or due to the economic headwinds. Wealth management transactions, including stock, foreign exchange, time deposit, mutual fund and certificate of deposit, have surged by 110% in the first half of 2020.