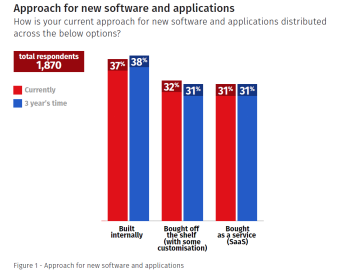

A recent global study revealed that businesses were circumspect when choosing between buying SaaS apps or relying on their own apps/resources.

Enterprises are constantly weighing the benefits and drawbacks of building their own solutions in-house or purchasing existing solutions to fit their individual needs.

Over the past decade, this decision has been driven by the relative accessibility and ease of each approach. Consequently, the build/buy equation has fluctuated back and forth, with organizational preferences leaning toward the method with the most accessible tools at a particular moment in time.

In order to understand what the build-or-buy equation holds for the future of cloud applications, a survey was conducted in September 2020 across 1,870 CIOs, CTOs, COOs, IT Directors and other senior IT decision makers in the USA, LATAM, EMEA and APJ industries including: technology, manufacturing, retail, media, financial services and the public sector.

The survey included 600 Asian respondents from Australia, Hong Kong and Singapore.

Build or buy sentiments

The key findings from the “To Build or To Buy?” survey by Rackspace Technology include the following conclusions:

- The decision is becoming more strategic

While the ratio of building vs buying applications has not changed, the way that customers assess whether to build or buy has changed.

According to the interpretations of the data, tech decision makers apparently do not plan to move strictly away from build and toward buy (or vice versa), but rather to choose strategically when to build and when to buy.

For example, 72% of Asian respondents prioritized building customized applications for customer-facing purposes because it created differentiation, as 67% of respondents ‘agreed’ that DX and the need for differentiation were driving the need to build applications in-house. This indicates the preference that valuable developer hours should be used to build applications will eventually impact customers and revenue in a positive way. - When building apps in-house, low-code/no-code solutions may be a smarter choice

Within the build approach, 77% of participants said their organization used low-code/no-code platforms and 87% said they were satisfied or extremely satisfied with low-code/no-code development. Taken at face value, this could imply a trend of ‘working smarter’ where application development is democratized and leverage user-friendly build tools to bridge the gap in developer skill sets. - When preferring to buy apps, SaaS adoption may be preferred

61% said ease of use and implementation of Software-as-a-Service (SaaS) products were the main reasons for preferring to buying apps instead of building in-house. Further, 64% of participants did cite that differentiation was also possible with today’s SaaS advancements and customizations. The research points to a rise in SaaS as the preferred option when buying applications to enhance crucial but non-differentiating areas of business.

Said Jeff DeVerter, Chief Technology Officer, Solutions, Rackspace Technology, a multicloud solutions firm that commissioned the survey: “When it comes to the buy-vs-build dilemma, rather than one approach dominating the other, our research and experience tell us that both methods have immense value if implemented for the right reasons. It’s clear that right now the trend is to reserve developers and their build time for the highest impact work while filling in the gaps with purchased technology.”

According to DeVerter’s team mate Sandeep Bhargava, Managing Director for the Asia Pacific Japan region: “It has been a long-standing debate about whether an organization should build software solutions, using in-house IT resources or buy market-ready products. Respondents in Asia have indicated that building applications internally was their favored solution after evaluating all factors.”

Bhargava hoped that IT teams can work closely together with the senior management teams in organizations to provide the necessary IT solutions based on the vision and strategy of the business.