A meta-analysis of the year’s grossly-upended e-commerce landscape showed that groceries and apparel were also hot, and understandably so!

In combining analyses of 1 trillion visits to US-based retail websites, sales data of more than 100 million unique products and a survey of 1,000 US consumers, it has been concluded that electronics is one of three categories (along with grocery and apparel) that has had a heavy influence on online economy trends in the Americas.

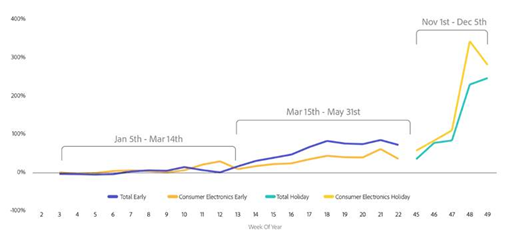

During last year’s turmoil in the country, the consumer electronics segment was not as strong in the initial phase of the COVID-19 pandemic compared with that of other business-to-consumer segments. Subsequent holiday shopping events changed that, driving an increased demand for electronics.

In those spurts of 10/10, 11/11, 12/12, Black Friday, Cyber Monday and year-end shopping sprees amidst lockdowns, consumer electronics retailers promptly outpaced other e-commerce segments’ overall growth in the first part of the season.

Other e-commerce trends

All the above trends, gleaned by Adobe digital economy researchers, were framed by pandemic-control measures, including reactionary trends such as upgrading home offices, keeping fit and sane when cooped up at home with too many people, and so on. Other observations include:

- Electronics prices are now beginning to plateau in the country, thanks to the absorption of offline purchasing into the online electronics category and COVID-19-associated demand.

- There has been a 44% drop in online prices for electronics between the years 2014 and 2020.

- Price was one of the top three buying criteria of electronic devices purchases in 74% of consumers, preceded by quality (82%) and ease of use (77%).

- Consumers bought more electronic devices in 2020 – with almost every trending product seeing an increase:

- 31% of participants owned a smart speaker in 2020 compared to 26% in 2019.

- 66% owned a laptop in 2020 compared to 62% in 2019.

Finally, one out of three consumers in the entire study purchased a voice-controlled device in the past year, with Millennials and Gen Z leading the charge. Privacy remained a significant in respondents and data analyses, particularly for Baby Boomers, whereas Gen Z were the least concerned.