These Central Bank Digital Currencies (CBDCs) can foster financial inclusion and modernize the global payments ecosystem, with concept testing already underway.

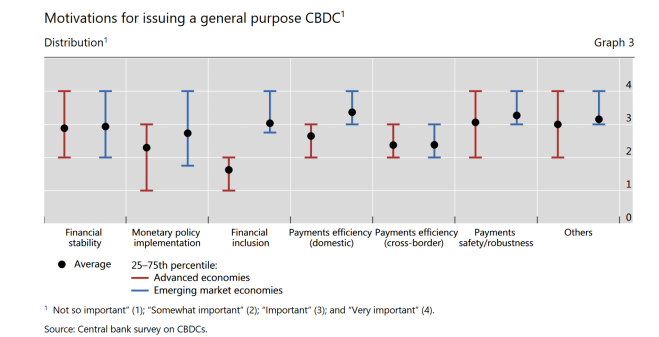

With the global economy racing to embrace digital payments, the central banks of various countries are also investigating ways to support innovation while maintaining monetary policy and financial stability when issuing and distributing currency.

Reportedly, 80% of central banks are engaging in some form of Central Bank Digital Currencies (CBDCs) work, and about 40% of central banks have progressed from conceptual research to experimenting with concept and design, according to a recent survey by the Bank for International Settlements.

CBDCs are designed to be equivalent in value to a nation’s paper currency and are subject to the same government-backed guarantees. In addition to printing money, central banks can issue CBDCs as a digital representation of a country’s fiat currency.

The birth of digital fiat money?

According to the Head of Blockchain, Digital Assets and Data Policy at the World Economic Forum, Sheila Warren: “Collaborations between the public and private sectors in the exploration of Central Bank Digital Currencies can help such banks better understand the range of technology possibilities and capabilities available with respect to CBDCs. Central banks can benefit from support in exploring the option set available to them with respect to CBDCs, as well as (in) gaining insight into what opportunities may be forthcoming.”

To facilitate virtual testing for central banks to evaluate CBDC use cases, a proprietary platform has been created to simulate issuance, distribution and exchange of CBDCs between banks, financial service providers and consumers.

Central banks, commercial banks, and tech and advisory firms have been invited to partner the firm to assess CBDC tech designs, validate use cases and evaluate interoperability with existing payment rails available for consumers and businesses today.

Catering to realistic testing

While a variety of potential operating models exist for CBDCs, the primary approach sees central banks issuing and distributing currency, including digital currencies, through commercial banks and other licensed payments providers.

As every central bank differs in its exploration of CBDCs, and the virtual platform can be individually customized to the environment in which each central bank operates, allowing any bank to:

- Simulate a CBDC issuance, distribution and exchange ecosystem with banks and consumers, including how a CBDC can interface with existing payment networks and infrastructures, for example, cards and real time payments.

- Demonstrate how a CBDC can be used by a consumer to pay for goods and services anywhere Mastercard is accepted around the world.

- Examine various CBDC technology designs and use cases to more quickly determine value and feasibility in a market.

- Evaluate CBDC development efforts including the technical build, security and early testing of the design and operations.

Said Raj Dhamodharan, Executive Vice President, Digital Asset and Blockchain Products and Partnerships, Mastercard, the firm behind the proprietary testing platform: “Central banks have accelerated their exploration of digital currencies with a variety of objectives, from fostering financial inclusion to modernizing the payments ecosystem… This new platform supports central banks as they make decisions now and in the future about the path forward for local and regional economies.”