Hold your horses (or ThreadRipper horsepower)! Getting rich quick this way is foiling the efforts of global ESG movement and initiative!

Many of us know by now that the crypto-mining craze worldwide drove the prices of graphics processing units (GPUs) to ridiculous prices in the past year.

This was exacerbated by a subsequent supply crunch due to the coronavirus pandemic, and the profiteering of market scalpers. Result: a mid-range US$700 graphics card could fetch $1,000 in the right situation. Even used GPUs are being sold at or higher than the original purchase price!

The only way many gamers and technical professionals needing a good GPU could get their hands on one was to buy a pre-specified system configuration from a DIY PC shop and maybe even wait a few months before the shop owners could land some stocks for themselves.

Now, with HDD Mining (also called storage mining) catching on, the prices of hard disk drives have also shot up substantially, with no plateau in sight.

The skyrocketing prices of computing components—from GPUs to SSDs and HDDs to who-knows-what else in crypto-mining is truly a scourge that needs to be kept in check before its ill effects cascade throughout the technology world. Environmentally, crypto-mining technology is anathema to global efforts to reduce our carbon footprint, while the occasional outcomes of ridiculous get-rich-quick crypto-fraud and crypto-investment schemes may actually corrupt the mentality of desperate people in a desperate ‘pandemic-onomy’.

The dark side of crypto speculation

The proper and socio-political benefits of cryptocurrency and blockchain technologies have been well documented, so we need not broach that well-trodden road here. Of increasing concern are the negative implications of crypto-mining abuse and antisocial intent that need addressing. Here are some inconvenient truths:

- The Cambridge Bitcoin Electricity Consumption Index from Cambridge University estimates the activity’s electric consumption at 133.68 TWh per year. That is equivalent to the power consumption of Sweden’s or Poland!

- According to some studies, a single Bitcoin transaction has the carbon footprint of 549.74 kgCO2, equivalent to more than 90,000hours of watching Youtube, which in itself has already been featured as a bad trend in many eco-sustainability reports.

- According to data in Statista, one Bitcoin transaction requires the power that could process 100,000 VISA transactions worldwide.

- Investopedia notes that bitcoin (and presumably other cryptocurrency contenders) generates around 11.5 kilotons of e-waste yearly. Data from the Global e-Waste Monitor 2020 shows how damaging the wastage is to all the combined sustainability efforts in the world. And this wastage is set to increase by 38% in the next few years if nothing is done to raise ESG awareness about the importance of revamping crypto-mining to eliminate ecological strain on the Earth’s natural resources.

- ‘Proof-of-stake’ consensus mechanisms are starting to take root, but with the craze to capitalize on the 21-million Bitcoin limit raging hotter than the SARS-COV2 pandemic, more regulation and industry introspection are needed before proof-of-stake and competing eco-friendly solutions fizzle out.

- Even sustainability ‘champion’ Bill Gates, who has profited handsomely from Bitcoin and presumably similar cryptocurrency, has noted that it “uses more electricity per transaction than any other method known to mankind,” adding that “it’s not a great climate thing.”

Crypto fear and greed

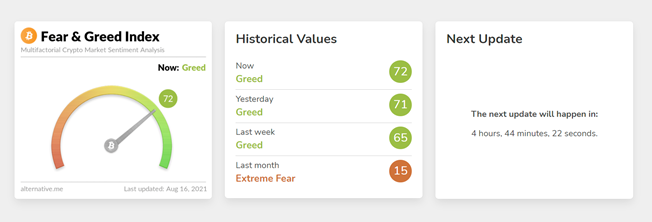

Ever heard of the Crypto Fear & Greed Index? According to the founders, crypto-punting behavior is very emotional. People tend to get greedy when the market is rising, which results in FOMO (Fear of missing out). “Also, people often sell their coins in irrational reaction of seeing red numbers. With our Fear and Greed Index, we try to save you from your own emotional overreactions. There are two simple assumptions:

― Mahatma Gandhi

- Extreme fear can be a sign that investors are too worried. That could be a buying opportunity.

- When investors are getting too greedy, that means the market is due for a correction.

Therefore, the website analyzes the current sentiment of the markets and crunch the numbers into a simple meter from 0 to 100. Zero means “Extreme Fear”, while 100 means “Extreme Greed”.

In the broader financial markets, Warren Buffett’s comment about fear and greed is: “Be fearful when others are greedy and greedy when others are fearful.” But in the perspective of sustainable and ethical technologists, when the measure of greed continually hovers near the extreme, that is when “for greed, all nature is too little.” (Lucius Annaeus Seneca, 4BC-AD65)

As for fear, one ubiquitous source is the group of advanced persistent threat and cyber-hacker groups. More than US$300m of cryptocurrency was stolen (after half of the loot was mysterious returned) just this month! Decentralized Finance (DeFi) DeFi-related fraud is also on the rise. In the first seven months of the year, it comprised 54% of total crypto fraud versus 3% for all of 2020.

Adding to the audacity of crypto craze, the former chair of the US Federal Reserve, Janet Yellen, had declared: “The Federal Reserve simply does not have authority to supervise or regulate Bitcoin in any way.” Such remarks must have motivated people who have a bone to pick with the global banking system to get back at the money masters!

Unfortunately, the combined motivations of greed, envy, vengeance and fear will be brought to bear on future generations when being born in to crypto wealth is meaningless in a polluted, morally corrupt, and self-destructive world.