Meanwhile, case studies across six sectors in the Asia-Pacific region are showcased for their data-driven recovery.

Deep data insights are driving COVID-19 recovery strategies across all industries, including the travel and entertainment sectors where promising signs of improvement are starting to emerge, according to two reports by Mastercard that analyze how companies and consumers are weathering the pandemic and preparing for the future.

The first report features case studies on six sectors in the Asia Pacific region (APAC): restaurants, finance, mass retail, health & beauty, travel and government, and how effective tactics were used to harness the power of analytics, including performance clustering, phased benchmarking and consumer segmentation. The specific examples also connect to broader themes for each industry on how to use the right data, tools and expertise to understand the impact of a crisis and drive response strategies.

Said Donald Ong, Senior Vice President, Mastercard Advisors, Asia Pacific: “Businesses in APAC have been dealing with the pandemic longer than anywhere else. In the midst of continued uncertainty in the operating environment and the ongoing change in consumer sentiment and behavior, businesses need a compass to chart their path to growth and many are finding that clarity through data-driven insights. Combined with analytics expertise, agile strategic planning, a relentless focus on the changing consumer, and a sharp pivot to digital, these businesses are clearly accelerating their pace of recovery.”

APAC travel recovery provisos

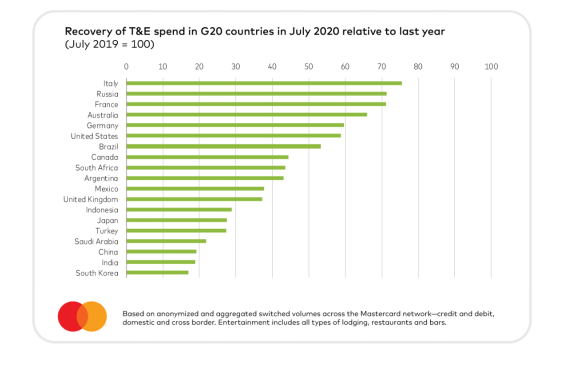

The second report identifies key trends in the Group of 20 nations that reflect broader consumer spending patterns—in particular the shift to a smaller retail radius as people travel and spend closer to home.

The analysis of anonymized and aggregated transaction activity across the Mastercard network shows Italy, Russia and France are leading the recovery in travel and entertainment spending, largely as a result of the opening of European corridors.

In many APAC markets, the recovery may depend more on domestic sentiment than on regional travel arrangements. Some trends are showing:

- Travel your own country: Consumers are getting out and spending but maintaining a tighter footprint with a ‘home-centered’ retail radius.

- Boutique lodging: Travelers are increasingly opting to stay with small accommodations—with a rise in spending at boutique hotels. The global recovery rate of small independent hotels has outpaced the recovery of large hotels by more than 50%.

- Commercial travel vs consumer travel: An analysis of consumer cards compared to business cards shows that spending on consumer air travel and auto rentals is returning ahead of commercial travel.