Over three global studies, a digital transformation index has shown what COVID-19 has prescribed for the world’s business leaders.

Organizations have been shifting their digital transformation programmes into high gear and are on the path to accomplish in a few months what would normally have taken them years.

In July and August 2020 4,300 business leaders from mid-size to large organizations across 18 countries, were surveyed for the compilation of global benchmark indicating businesses’ status of transformation. For the Asia Pacific and Japan region (APJ) 1,700 business leaders from Australia, India, Japan, mainland China, New Zealand and Singapore were surveyed. The respondents’ digital business efforts were classified by IT strategy, workforce transformation initiatives and perceived performance against a core set of digital business attributes.

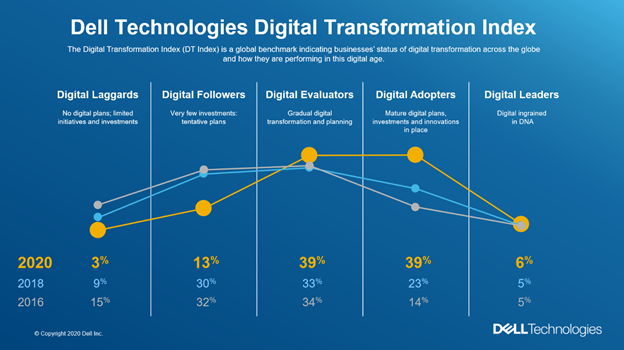

The findings, updated biennially in the Dell Technologies Digital Transformation Index (DT Index), are the third installment of the index since its appearance in 2016 and 2018.

In one of the first global studies to measure business behaviour as a result of the pandemic, this year’s DT Index found that eight in 10 organizations (APJ: 84 percent) have fast-tracked some digital transformation program this year and 79% (APJ: 86%)are re-inventing their business model.

A new DX curve

This year’s results tracked the first rise in the number of Digital Leaders (the most digitally-mature organizations) to 6% globally. Digital Adopters (the second most digitally-mature group) has grown from 23% in 2018 to 39% to date globally: a 16% increase.

In APJ, the number of Digital Leaders remained the same from 2018, at 6%. The number of Digital Adopters in APJ grew from 23% to 39%: a 16% increase.

This year, the DT Index recorded a modest drop since 2018 in the number of Digital Laggards (the least digitally-mature group) by 6% points globally (APJ: 6%), and a steep fall in the second-to-last group, Digital Followers, by 17% globally (APJ: 13%). These organizations are moving up into the Digital Adopter and Digital Evaluator groups, which have expanded in tandem.

Dell’s Chairman and CEO Michael Dell said: “We’ve been given a glimpse of the future, and the organizations that are accelerating their digital transformation now will be poised for success in the Data Era that is unfolding before our eyes.”

According to Dell, economies recovering from the impact of a pandemic should understand transformation barriers and investment opportunities so that they can act quickly to drive new ideas, concepts and solutions that they need to either maintain or accelerate growth.

Barriers to DX

The pandemic may have catalyzed digital transformation across the globe, but continuous transformation is challenging: 94% of organizations (APJ: 96%)polled were facing entrenched barriers to transformation. According to the DT Index, the top-3 barriers to DX success were:

- Data privacy and cybersecurity concerns (up from 5th place in 2016)

For APJ, data privacy and cybersecurity concerns also topped the list (#1 in 2018) - Lack of budget and resources (#1 in 2016, #2 in 2018)

This was similar for APJ (#2 in 2018) - Inability to extract insights from data and/or information overload (a jump of eight places since 2016)

Again the same for APJ (#3 in 2018)

Foundational vs Emerging tech

Prior to the pandemic, business investments had been strongly-focused on foundational technologies rather than emerging technologies. The vast majority, 89% of global respondents (APJ: 92%) recognized that due to this year’s turmoil, they will need a more agile/ scalable IT infrastructure to allow for future contingencies. Here are the top technology cited investments for the next one to three years:

Global and APJ top technology investments:

- Cybersecurity (43%) [APJ: 42%]

- Data management tools (39%) [APJ: 41%]

- 5G infrastructure (37%) [APJ AI algorithms: 40%]

- Privacy software (35%) [APJ: 5G infrastructure: 36%]

- Multi-cloud environment (35%) [APJ: 36%]

For emerging tech, increased usage of Augmented Reality to learn how to do or fix things in an instant was cited by 82 per cent of respondents globally (APJ: 85%). The use of AI and data analytics to predict potential disruptions was also cited by 85% of global respondents (APJ: 88%).

Distributed ledgers such as blockchain were cited globally by 78% of respondents as a solution to making the Gig economy fairer by cutting out the intermediaries. In APJ this was 84%.

Finally, despite these findings, only 16% (APJ: 17%) were planning to invest in Virtual/Augmented Reality; for AI, it was just 32% (APJ: 40%); and for distributed ledger technology, a mere 15% (APJ: 16%) had plans in the next one to three years.