A regional digital healthcare investment study by a legal firm has yielded both opportunities and misalignments in outcomes and expectations.

Across the Asia Pacific region (APAC), a rapidly-expanding population, an empowered and tech-savvy middle class, and a shortage of doctors in the current global pandemic is accelerating digital health innovation while also creating fragmentation in the region.

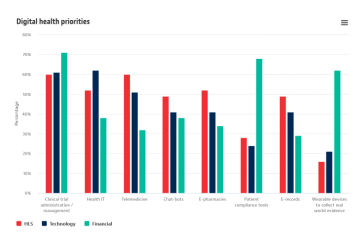

A recent survey of 750 healthcare, life sciences, tech and finance executives by legal firm Baker McKenzie has indicated that each group was prioritizing the development of digital health and experiencing rising market pressure to build new solutions and systems.

However, while all respondents ranked clinical-trial administration (presumably for urgent vaccine development work) as a high priority area, their priorities quickly diverged across other categories of digital health. Despite the vast threats and opportunities made available by the pandemic, the pressures of regulatory fragmentation, competing priorities and knowledge gaps are apparently impeding the much-needed development of digital healthcare in APAC.

Perceptions of misalignments

The new study of APAC digital health innovation also discovered perceptions of misalignment in terms of outcomes and knowledge. For example, 74% of respondents ‘agreed’ that greater collaboration across the healthcare ecosystem would significantly accelerate progress, but 78% of healthcare/life sciences companies reported concerns that technology organizations pushed a more commercial agenda over healthcare excellence. Furthermore, 71% of technology players indicated that healthcare companies often lacked the tech know-how to operationalize new solutions.

This misalignment in perceptions resulted in 72% of respondents across all groups to believe there was a need for a radical rethink of how innovation is organized, funded and scaled to meet demand for new solutions. Also, they perceived the complex, highly-regulated nature of healthcare ecosystems by governments, coupled with ‘misalignments between organizations’ business interests’ were barriers to accelerating digital healthcare innovation.

The research identified five key drivers of accelerated development digital health in APAC:

- Disruptions to traditional healthcare delivery and management due to the pandemic

- Advances in digital health technology

- Cost pressures in healthcare systems

- Perception of the healthcare sector as a ‘safe haven’ for investment amid economic downturns

- The requirement to provide personalized patient care

APAC digital health hotspots

Data of deal flows showed that digital health venture capital in APAC largely centered on the major population centers of China, South Korea, India and Japan. Some 62% of survey respondents cited Singapore as their top destination in the region for intended new investment and development in digital health, followed by Australia (56%).

This suggests Singapore as a developing hub for digital health innovation and cross-jurisdictional deal making in the region, in part due to the aggressive incentives that the country has introduced to attract investment.

Baker McKenzie Principal (Singapore) Ren Jun Lim said that governments could play a major role in supporting the sector through working towards regulatory harmonization across jurisdictions. “While digital health is accelerating in spite of regulatory complexity, harmonization can provide a confident basis for greater investment and innovation. If regulation was designed to support cross-jurisdictional, cross-industry collaboration, we would expect to see digital health innovation accelerate by a huge order of magnitude.”

In that regard, while 72% of digital health players surveyed believed that current government interventions can be counterproductive to innovation efforts to innovate—in reference to regulatory enforcement and cross-jurisdictional fragmentation—the fast-growing interest in Singapore as an digital health investment hub does suggest that grants, incubators and incentives are shifting the dial on digital health innovation. This approach also has the potential for developing economies to leapfrog some of the more traditional healthcare hubs through digitalization.

Data is the innovation driver

According to the firm, the Vietnamese government is seeking to modernize its healthcare system by attracting private investors, deploying public funds and encouraging public-private partnerships. Their healthcare sector is also tapping on high-growth players from across the country’s emerging digital economy, including digital health, fintech, and e-commerce—to pioneer new approaches in telemedicine, personalized medicine, health payments, drug delivery and patient record management.

These collaborations between government bodies, healthcare providers and technology companies, coupled with legal-framework reforms, can help Vietnam to overcome limitations and inefficiencies in the system, while also creating exciting investment opportunities and better patient and user outcomes in the healthcare space.

Said Elisabeth White, Head of Healthcare and Life Sciences (Asia Pacific) Baker McKenzie: “Data is the new gold. From healthcare records to wearable tracking data to payment information, it is the currency which drives digital health innovation and is shaping the next generation of digital health solutions and systems. It is critical to establish what relevant data collaborators bring into the partnership and, where a new and valuable dataset will be created, who is responsible for, has access to and is able to monetize this information and for what purpose.”